tax on unrealized gains uk

By example consider the owner of a large S corporation worth 200 million. According to the official justification to the Project the purpose of the regulation is to adjust the Polish tax provisions to the EU law.

How To Tax Capital Without Hurting Investment The Economist

Its the gain you make thats taxed not the.

/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)

. Taxpayers impacted by the tax on unrealized gains will be incentivized to move overseas in order to avoid the tax moving much-needed capital. As a general rule no. Macomber and Glenshaw Glass Co.

The accounts will also show unrealised gains or losses where such assets or liabilities exist at the end of the period of account and are retranslated into sterling at the closing rate see BIM39510. You only adjusted from exchange rate eg. In total 215 billion could be collected over nine years with Musk paying the most at 50 billion.

This creates an increased risk of unexpected taxable gains for companies. The competition is looking to track and report any transaction over 600 trying to normalize taxes on unrealized gains and doesnt understand that companies will raise prices if they have more. Tax on unrealized gains uk Monday February 21 2022 Edit.

Capital Gains Tax is a tax on the profit when you sell or dispose of something an asset thats increased in value. The ATAD Directive which regulates the unrealized capital gains taxation in the case of. Below are one economists estimates of what the top 10 wealthiest Americans would.

A further complexity arises in the. The High rates and additional rates taxpayers will pay 20. The proposed amendments are intended to correspond with Article 5 of the EU Council Directive 20161164 dated 12 July 2016 hereinafter.

Capital gains arise out of a disposal of the assetwhich can be by way of a sale or even a gift. A tax on unrealized gains would harm the economy. Under FRS102 we need to show the investments at market value at year end which is easy to do as they are publicly traded shares.

This reflects the 10k investment and the 5k unrealised gain. Our problem comes with regards to Corporation tax - my gut says that as the gains are unrealised. Since unrealized capital gains are exempt from taxation a person who has an asset that appreciates.

Yet that concept could change for billionaires pending an unrealized gains tax proposed by the Biden Administration in late March 2022. The result is an unrealised gain of roughly 30000. I understand there has to be a fair value adjustment in the PL to refelct the increased value of the investment to 15k.

Taxable income in the US. Under the Internal Revenue Code of 1986 is predicated upon gross incomewhich the US. The basic tax rule in the UK is that foreign exchange movements on loans and derivatives are taxabletax deductible as they accrue.

The first issue is that under the existing rules capital gains are only included in income for tax purposes when an item is sold and the gains are realized which implies that the seller receives a profit because of the sale of the asset. However on death a persons assets are valued and may be subject to inheritance tax That is the current position however those of a socialist. Corporate - Income determination.

That would be a 30 capital loss for you. However it was my understanding that unrealised gains of this nature should be stripped out of the calculation for Corporation Tax. Unrealised gains on investment shares - is Corp tax chargeable.

Are the leading cases. For example if you buy a house for 200000 and the value goes up to 210000 your basis is 200000 and you have a 10000 unrealized gain. In this article we go back to basics on the taxation of foreign exchange from a UK corporation tax perspective and also consider some of the options available to businesses to enable certain foreign exchange volatility to be managed from a tax perspective.

If you are in the 15 tax bracket for the State of California your capital gains tax rates are as follows. If the value drops to 190000 you have a 10000. What are unrealized gains.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. Find out what happens in the meantime. If you hold an asset for less than one year and sell for a capital gain the difference between your purchase price and your sale price will be subject to short-term capital gains taxes.

Assume you bought a stock at the price of 100 and it decreased to 70 and you sold it. Short-term capital gains are taxed at your ordinary tax rate. Below are one economists estimates of what the top 10 wealthiest Americans would owe on their unrealized capital gains alone.

The amount youll pay in capital gains taxes depends primarily on how long you held an asset. Total profits are the aggregate of i the companys net income from each source and ii the companys net chargeable gains arising from the sale of capital assets. Law360 October 25 2021 534 PM EDT -- New levies on the earnings and unrealized capital gains of wealthy individuals have emerged as.

Last reviewed - 30 December 2021. The main sources of income are i profits of a. Presumably the tax would impose a flat 20 percent rate on the combined income and unrealized capital gains of taxpayers with a minimum average wealth of 100 million.

If youre a basic rate taxpayer you have t o pay 10 on your gains on normal assets but you have to pay 18 on the property as CGT. For example your pocket cash is USD it is still USD. 1KHR 4000 to another exchange rate eg.

Again under Bidens plan they would be required to pay a minimum 20 income tax on this appreciation. This means that tax liabilities can arise from exchange gains which are unrealised and so are unfunded. Under the proposed Billionaire Minimum Income Tax households with a cumulative annual income over 100 million could face a sizable 20 tax bill that includes the sum total of their unrealized gains.

Supreme Court has taken to mean an accession to wealth that is clearly realized. If youre holding stocks or other assets the act of selling them for a profit or at a loss results in gains and losses. This owner employs hundreds of workers and the business is the economic cornerstone of a small community.

An unrealized gains or losses are also called a paper profit or paper loss because it is recorded on accounting systempaper but has not actually been realized. All references are to Corporation Tax Act 2009 CTA 2009 unless otherwise stated. Unrealized gains and losses occur any time a capital asset you own changes value from your basis which is usually the amount you paid for the asset.

A UK resident company is taxed on its worldwide total profits.

The Taxation Of Carried Interest Why Critics And Proponents Are Both Wrong

How Are Dividends Taxed Overview 2021 Tax Rates Examples

Capital Gain Formula And Taxes On Unrealized Realized Gains

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

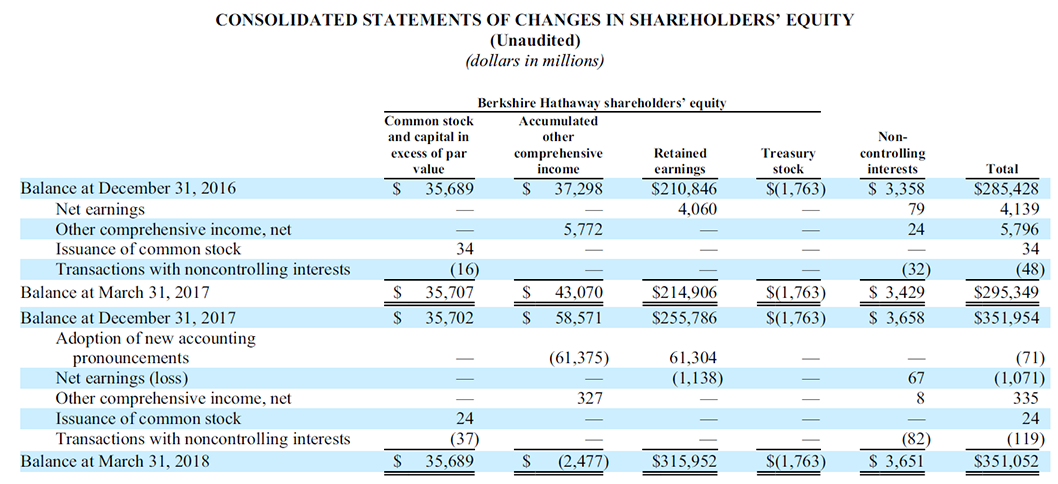

Berkshire S Bottom Line More Relevant Than Ever Before Cfa Institute Market Integrity Insights

Derivatives And Hedging Accounting Vs Taxation

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

Crypto Tax Unrealized Gains Explained Koinly

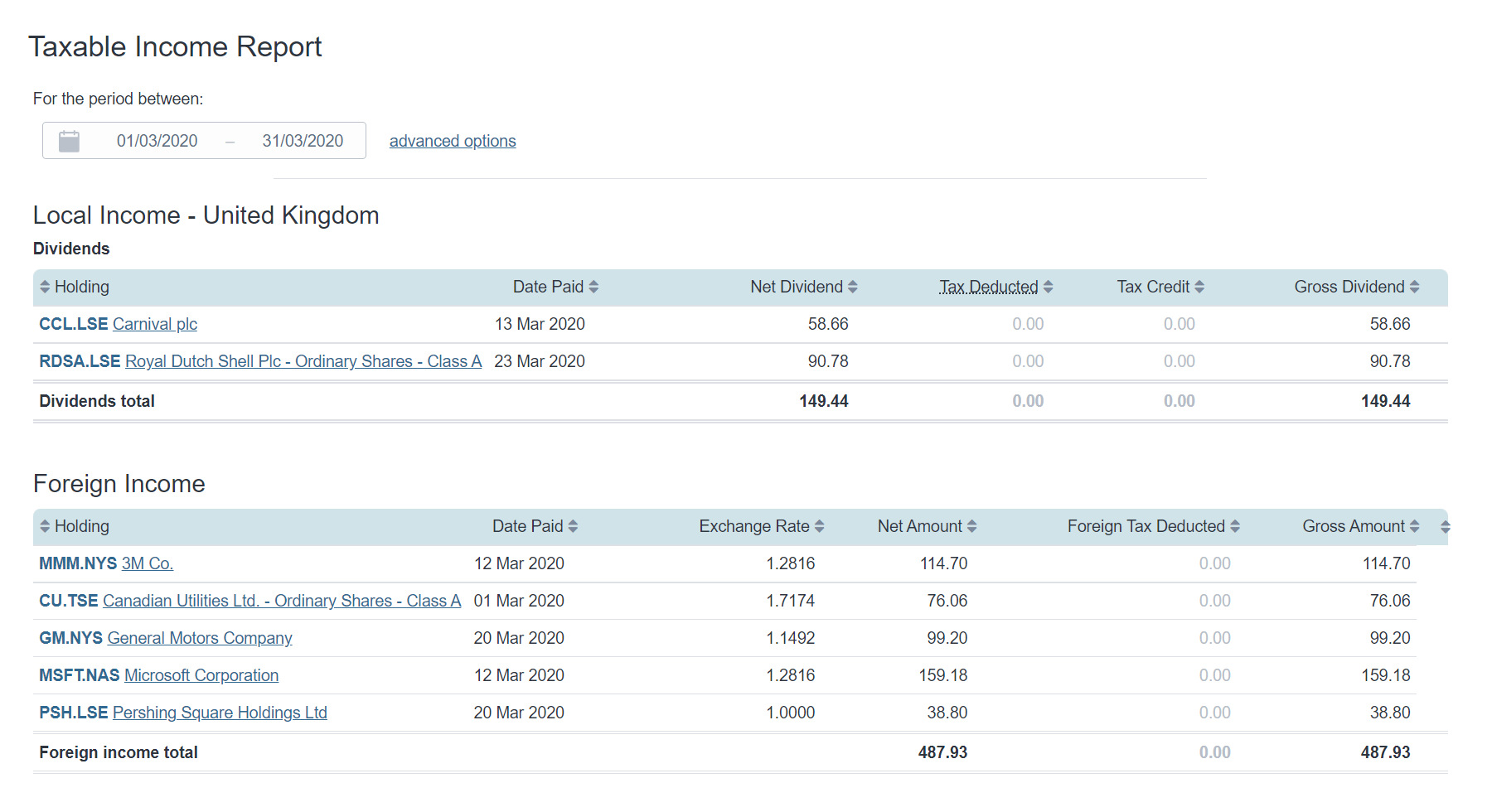

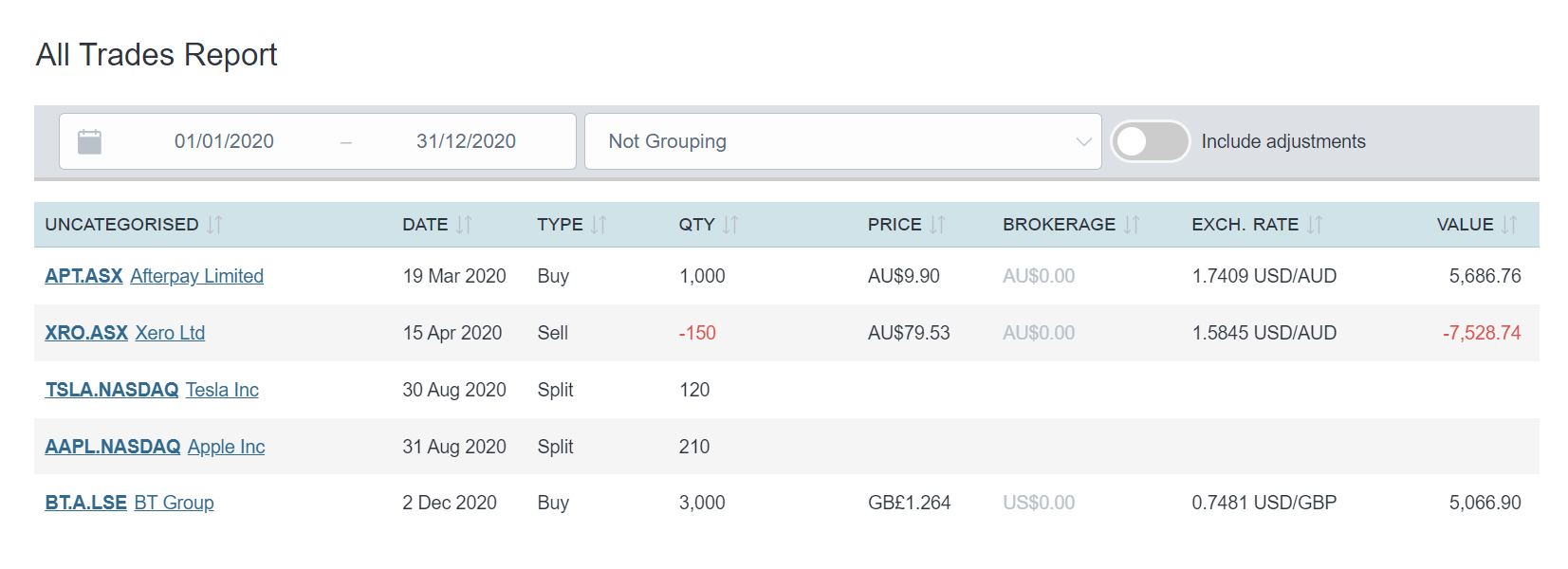

Investment Portfolio Tax Reporting Sharesight Uk

The Unintended Consequences Of Taxing Unrealized Capital Gains

:max_bytes(150000):strip_icc()/dotdash_Final_Deferred_Tax_Asset_Definition_Aug_2020-01-dab264b336b94f939b132c55c018f125.jpg)